We graduated to Setu 2.0 today by building a bridge with Pine Labs#

As of today, almost every Fintech company in India is expanding its horizons. Many are launching their own native API infrastructure, companies that are not in payments are trying to enter payments, companies that are in payments are trying to enter lending, and so on.

Each of these companies is attempting to expand to larger markets and serving more use cases. This trend is only poised to continue leading to increasing consolidation in the Indian fintech industry.

Today we announce a watershed moment of consolidation in Indian Fintech. Setu is becoming a part of one of India’s most enduring, ubiquitous, and pioneering fintech companies —Pine Labs. Together, we’re setting out to build India’s boldest fintech. And we couldn’t be more excited!

But it is interesting that this is also a strategically glorious exchange of missing parts for both Setu and Pine Labs. The latter acquires world-class engineering and product capabilities in embedded finance infrastructure, which is the most exciting era of Fintech. Setu on the other hand, gets to keep her brand, the culture, the beautiful office space in Central Bengaluru, her business and her customers.

More importantly, we will be able to dramatically amplify our reach and our impact, while we will continue to retain our soul after the acquisition.

### The evolving digital landscape in India

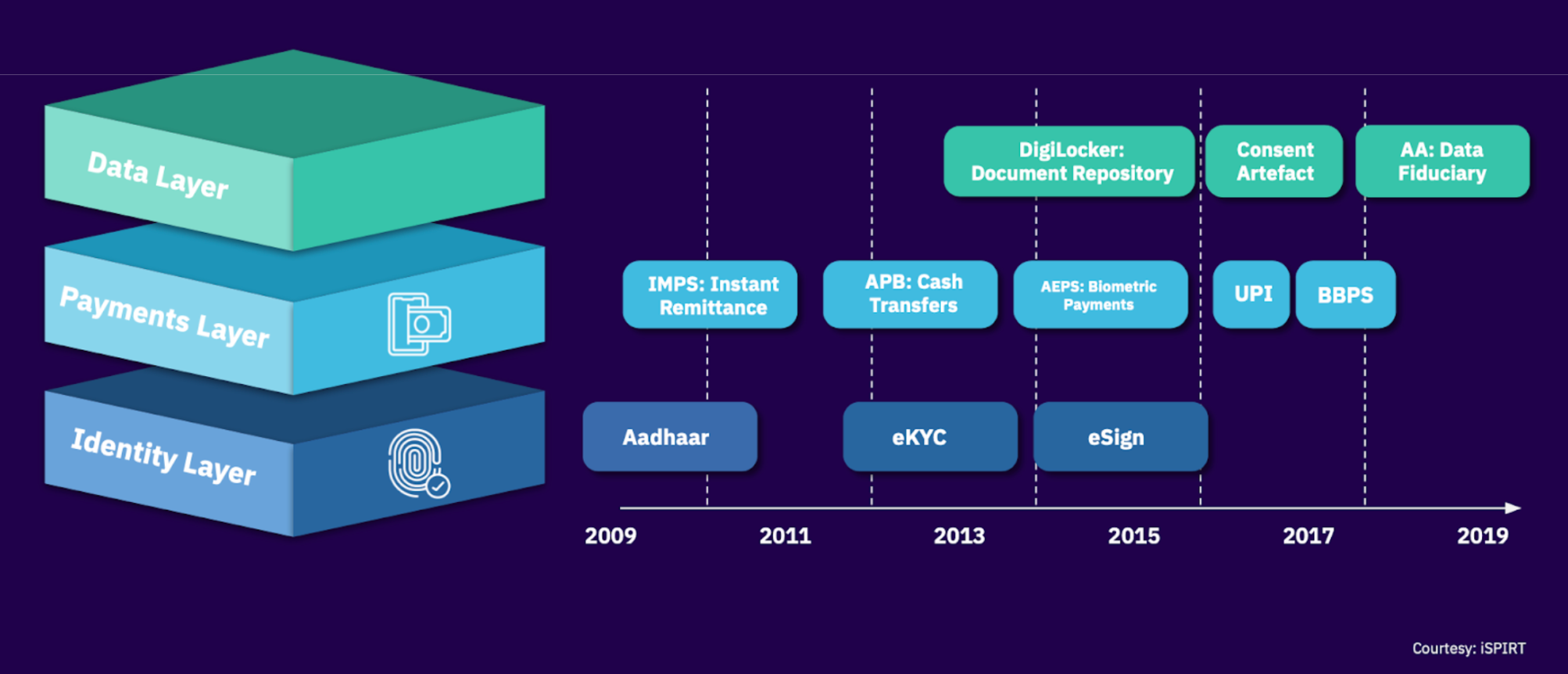

We are going through a massive digital transformation as a country. Needless to say, it started with the introduction of the UIDAI system and Aadhar in 2009.

- Today, 1.22 billion Indians are enrolled on Aadhaar. The total number of bank accounts more than doubled since 2011, which stands at 81 percent as of today.

- 750 million unique mobile connections. 616 million internet users. Over 10 million businesses registered on the GST portal.

- 5.8 billion digital payment transactions were made as of April 2022, amounting to Rs 9.6 trillion.

And this opportunity is attributed to digital public infrastructure like Aadhar and UPI on top of which Setu was built —the hook between Aadhar, UPI, eKYC, eSign, BBPS, Account Aggregator (AA) and how these powerful tools can also power financial access to billions of indians.

On top of these layers are more frameworks such as the Open Credit Enablement Network (OCEN), the Open Network for Digital Commerce (ONDC), Buy Now Pay Later (BNPL), Save Now Pay Later (SNPL). Each of them targeted at increasing the credit penetration for Bharat.

Redseer estimates that the BNPL market in India is set to grow by over 10x in the next 4 years. Today, it is pegged at about $3.5 billion, and it is expected to hit the $50 billion by 2026. It has about 10-15 million users and it is poised to hit 100 million users as the market continues to grow.

Our hypothesis is that over 500 million new users will make digital payments digitally in the next 5 years while digital public infrastructure like UPI, Aadhar, Digilocker and Account Aggregator will significantly lower the transactional and on-boarding costs. Subsequently, it would lead to opening of millions of new accounts across payments, insurance, investments, lending and financial advisory services.

We believe that this entire shift would carve out a whole new era of hyper personalisation that would allow fintech applications to seamlessly handle high-volume transactions of even smaller ticket sizes, and also be profitable at the same time.

### The origins of Setu

Under Nandan Nilekani’s leadership, an entire team at iSPIRT was bringing large-scale public infrastructure like Aadhar, UPI, GST, WANI into reality. Both of us met during this time, and we were quoting each other on how we can fully leverage this existing infrastructure to build better infrastructure on top, to reimagine financial products and enable financial inclusion for India.

The answer —by building a new stack of products in lending, payments, and other financial services and embedding them into third-party applications. We bounced off an idea for a platform product studio to Nandan and Sharad Sharma, the cofounder of iSPIRT.

Nandan knocked some sense into our heads.

“That's just consulting. You’re only selling your time and expertise in exchange for money, but how are you going to drive the change and create disproportionate value for the country?”

But then again, that’s just Nandan. Whether it’s Aadhaar or UPI or WANI or GST, he likes to go all in. He likes to build it all for Bharat, and he wanted us to do the same.

Tinkering further, we wanted to narrow down on an idea to disassemble all the services and offerings by financial institutions, turn them into plug-and-play APIs, and give anybody and everybody a chance to become a Fintech company.

Now by everyone’s standards of scale and impact, including that of Nandan’s, this audacious idea was a go. On 19th September, 2018, Setu went live.

### The journey so far

The road hasn’t been very smooth for us after the launch. It took almost 18 months to build and ship our first product, Setu Collect. But it clocked more than Rs 1.7 crore in gross transaction value within the first month. A couple of more big wins came through long-term partnerships with two major banks, Axis and IDFC First.

And then, the COVID-19 pandemic had struck. There were concerns that banks were not willing to kickstart any digital initiatives, but only focus on optimising for the pandemic and the aftermath.

But none of our milestones were affected in any way. The response we had received from both large banks and developers in our first 18 months, has made it amply clear that the market really needed the infrastructure we are building.

The bridge was officially built, and it was very much alive.

Some highlights of our journey so far—

A super emotional moment for our team was when Google’s CBO Philipp Schindler mentioned Setu in the Q3 2021 earnings call while Sundar Pichai was on it. Google had partnered with us to enable Fixed Deposits on Google Pay. It was the first time any FD was being embedded on to a third-party app for consumer bookings.

Multiple alumni of Setu (Setuzens as we like to fondly call ourselves) are now building innovative products and starting their own ventures today.

Like all good things in life, financial inclusion for billions of Indians also does take time. We would be able to see this massive behavioural shift only in hindsight, only after years or even decades.

- - -

## Our road ahead as Setu 2.0

Fiat Automobiles picked up a 50 percent stake in Ferrari in 1969 and raised it to 90 percent in 1980, until the separation finally spun off in 2016. But Ferrari didn’t stop making Ferraris, they won 10 championships during these 26 years. PhonePe was bought out by Flipkart when it was hardly 6 months old. 5 years later, Flipkart spun off PhonePe as a separate company, and PhonePe was still a pioneer in digital payments.

Slack and Salesforce. Pixar and Disney. The examples are countless, where a company resided within a larger group and has built something exceptional. Some of them even went on to be independent again.

In this generation, we are tempted to perceive startup exits as complete closures of those companies. It’s easier to look at starting up only as raising venture capital, valuing these enterprises based on future success of the company, chasing the very valuation everyday while also watching your cash burn, and hoping that these two metrics will magically meet at some point. Some succeed, most don’t.

But it need not necessarily be the only way of running a sustainable and large-scale business. If anything, exits such as ours at Setu may as well be the ‘newest way’ of building an enduring business.

Because Pine Labs today, works with the largest network of Buy Now Pay Later (BNPL) issuers in the country. One of the many interesting monetisation opportunities for us at Setu would be to take these same merchant integrations and offer them in a much more aggregated manner.

And of course, there is Open Network for Digital Commerce (ONDC) by which a large number of offline merchants are brought on to the online world and are empowered enough to compete directly with large-level ecommerce companies. Pine Labs again has one of the largest networks of ecommerce merchants.

There are numerous inter-operable technological adjacencies between Setu and Pine Labs because of which both the companies can go to the market together. As Setu 2.0, our goal now is to transition from ‘project thinking’ to ‘product thinking’ while proactively innovating on newer opportunities with large-sized addressable markets and tailwinds.

Impact. Innovation. Profit. An ARR of $10 million in 2 years, and $100 million in 5 years. This is what our focus is going to lie at, until we are truly profitable at scale.

The vision for us as we graduate to Setu 2.0 today is to become the country’s best and number one digital infrastructure company in India for Financial Services.