Why are wealth-tech startups turning to Account Aggregator now?

6 Mar 2023 — PRODUCT

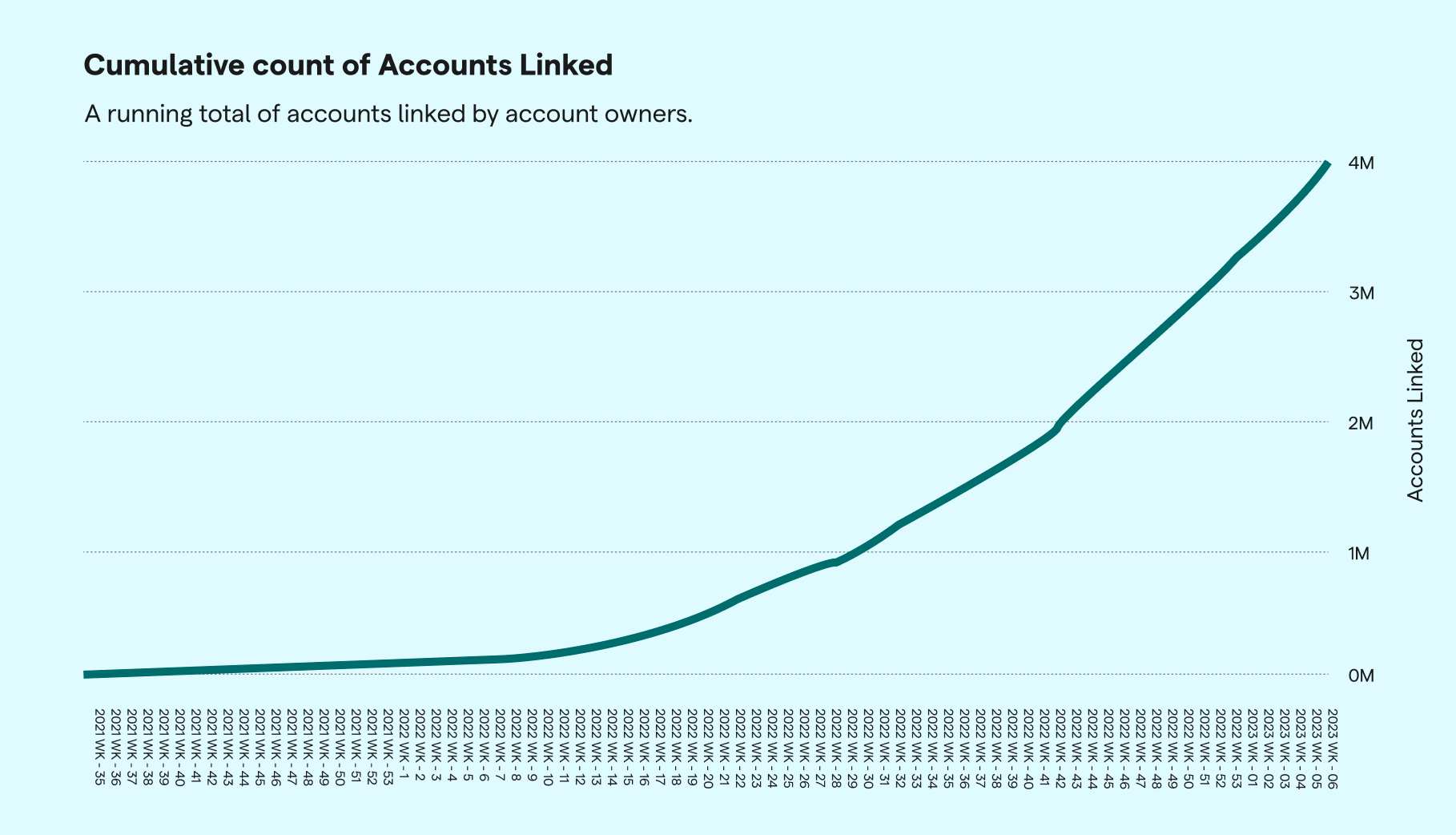

It’s been over a year since the first data fetch on the Account Aggregator framework was serviced. Since then, the number of unique citizens and data fetches on the platform have been climbing steadily. Now, we are at the cusp of a hockey-stick growth. Hear us out.

Sign up here to get started with Setu's Account Aggregator.

A majority of these users were on-boarded onto the AA ecosystem while applying for a loan, through a lending company. Lending companies collect a user’s bank account statement to verify their income, since it helps the lender gauge whether the borrower has ability to repay the corresponding monthly EMIs.

So, while the first wave of growth in AA was led by lenders, the last few months has seen higher adoption by other wealth-tech startups. Here’s why—

Consolidated view of a user’s investments:#

#

Wealth-tech startups help their users open demat accounts and invest money in stocks, mutual funds and fixed deposits. However, customers usually have multiple demat accounts through multiple apps. They could be using a Zerodha and a Groww. Because of this, it becomes difficult for one single platform to show a consolidated view of a user’s investments across multiple platforms. This is exactly what Account Aggregators can change.

Setu’s AA can provide analysed data that can help a wealth-tech platform present a detailed view of a user’s assets. Imagine being able to login to your primary wealth management app and see all your investments on one screen. Cool, huh.

Srikanth, CEO of Prime Investor says “Account aggregators present a unique and unprecedented opportunity for wealth-tech companies to serve their customers better and grow their businesses faster. With full visibility to a client's financial health—up to date and comprehensive—advisors can provide counsel in a precise manner confidently.“

Enable trading in derivatives#

#

While trading, you might have come across multiple segments like equity derivatives (futures and options), currency derivatives (CDS) and commodity derivatives (metals, energy, etc). These are relatively complex products that require more financial data before a trading platform can offer it to their users.

Also, platforms are mandated by SEBI to verify a user’s income before allowing access. It is basically done to protect investors from higher risk trading activity. This is usually approved by submitting one of the following documents—

-

Bank statement for the last 6 months with an average balance of more than ₹10,000.

-

The latest salary slip with gross monthly income exceeding ₹15000

-

ITR acknowledgement with gross annual income exceeding ₹1,20,000

-

Form-16 with gross annual income exceeding ₹1,20,000

-

Certificate of net worth more than ₹10,00,000

-

Statement of demat holdings with current holdings value exceeding ₹10,000.

As you can imagine, this adds a lot of friction for a user. Nobody has these documents handy so a user is expected to get this document somehow, come back and upload a large PDF file. The trading platform then parses this file and estimates whether the user is eligible or not. Using Setu’s Account Aggregator, trading platforms can enable their users to link their bank accounts to fetch analysed bank statement data to instantly enable derivatives trading.

Offer tailored, personalised financial advice to their users#

#

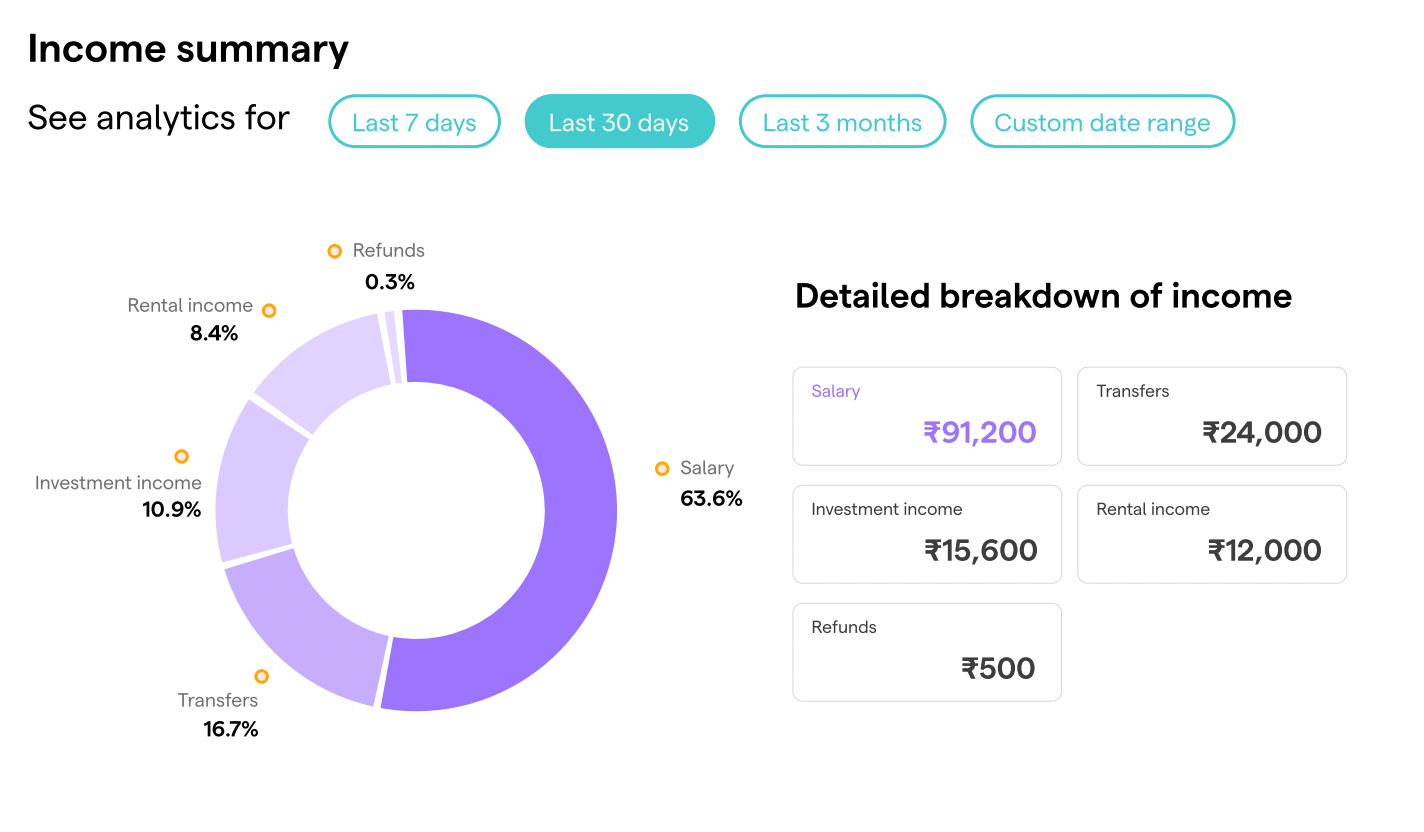

Most personal finance management and wealth tech apps struggle with aggregating or tracking a users’ income, expenses and investments in a single place. The other challenge with these apps is offering one-size-fits-all plans or advice, to very different individuals.

Why does a freelancer with very different streams of income, need to be offered a standard monthly SIP investment? For these apps to offer personalised advice to their users, they would need to understand multiple factors like monthly income, expenses, cash-in-bank, other investments, risk appetite and whatnot. Today, most of these are shared through 1:1 interactions and clunky file sharing.

Accounts aggregators allow these applications to get a view into not just the cash flows of these users to offer better payment or investment structures, but also suggest investment avenues based on their history, risk appetite and demographic profile.

Sign up here to start using Setu's Account Aggregator + Insights stack.

While the first wave of growth in AA was led by the lending industry, the next wave is going to be led by fintechs operating in the wealth-management space. The list of use-cases are endless.